Reflections from Bermuda

Reflections from Bermuda: Insights on Captive Insurance for Emerging Markets

Attending the Bermuda Captive Conference this year was a great experience. Bermuda has long been a global leader in the captive insurance space, and for good reason. With a strong regulatory framework and a wealth of experience, the island has shaped a model that others can learn from. What is clear is how much opportunity there is for emerging markets like Turks and Caicos (TCI).

The Flexibility of Captive Insurance

Captive insurance has always been of interest to me, especially its ability to offer businesses greater control over their risks. Traditional insurance can sometimes feel rigid, whereas captives allow companies to design bespoke solutions tailored to their specific needs. This flexibility becomes particularly important when managing new and evolving risks—whether it’s the rise of cyber threats or challenges brought on by climate change.

In markets like TCI, there is an opportunity to create an environment that mirrors this kind of adaptability. By building strong partnerships between local captive insurers, our regulator, and larger, more established players, we can nurture our markets growth, understand the market and deliver best in class solutions while staying agile at the cutting edge of innovative captives.

The Role of Public-Private Partnerships

One of the most impressive things I saw in Bermuda was how seamlessly the insurance sector has integrated with the broader economy. Public-private partnerships there aren’t just a buzzword—they drive the island’s success. The captive insurance industry contributes not just to business growth, but also to sectors like education, housing, and infrastructure. Much like our vision, it’s a model where both the industry and the community win. By aligning our emerging financial services sector with public policy, we will foster economic empowerment that reaches beyond the boardroom.

Navigating the Regulatory Landscape

Bermuda’s regulatory framework is often held up as an example of how to do things right. Their risk-based approach allows for flexibility while maintaining a robust system. What I admire most is how their regulators deeply understand the captive insurance market. This level of insight ensures that captives can thrive, even when dealing with risks that might be relatively new or uncharted

As we enhance our regulatory framework in TCI, there’s much we can learn from this model. A flexible, risk-based approach will be key to ensuring our market can handle emerging risks while maintaining long-term stability. The bifurcated system Bermuda uses, which distinguishes captives from larger commercial insurers, is also recognised by our Financial Services Commission (FSC) as an effective way of managing and mitigating the distinct risk profiles.

Learning from Challenges and Opportunities

Even in a market as mature as Bermuda’s, there are always challenges with issues like accommodation, infrastructure, and talent gaps in the insurance sector raised as topics of concern. These challenges serve as a reminder that growth needs to be sustainable and as we continue to build our industry, we’ll need to ensure that we address broader social and economic factors that can impact the success of our financial services sector.

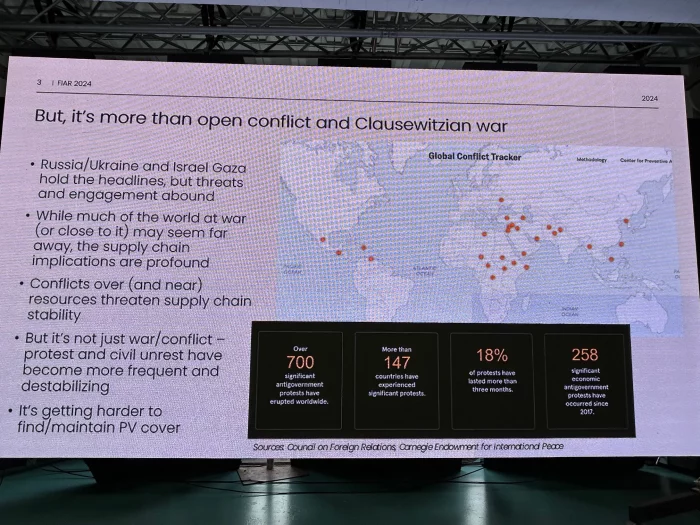

What’s also clear is that competition is growing, and as other jurisdictions develop their own captive insurance markets, there’s more reason to focus on niche areas of opportunity—such as insuring emerging risks in cyber and renewable energy. There’s a lot of room for innovation, and we’re in a great position to explore it.

The Value of Innovation

One of Bermuda’s strengths is its ability to innovate and adapt to new risks. Whether it’s creating micro-insurance for underserved communities or leading the way in cyber insurance, Bermuda shows how a market can stay relevant by anticipating the needs of a changing world. Innovation is critical and leveraging our pool of local expertise will ensure we design innovative solutions for the risks of tomorrow. A forward-looking approach is imperative in understanding the way this industry is moving and positioning TCI as a leader in fast-evolving landscape.

Looking Ahead: Building a Future-Ready Captive Insurance Industry

Reflecting on my experience at the Bermuda Captive Conference, I feel optimistic about the future of our captive insurance industry in TCI.

Our goal should be to continue to build a resilient, future-ready captive insurance sector that supports not just businesses but the wider community. By focusing on innovation, regulatory strength, and economic alignment, we will support the market for generations to come.